[ad_1]

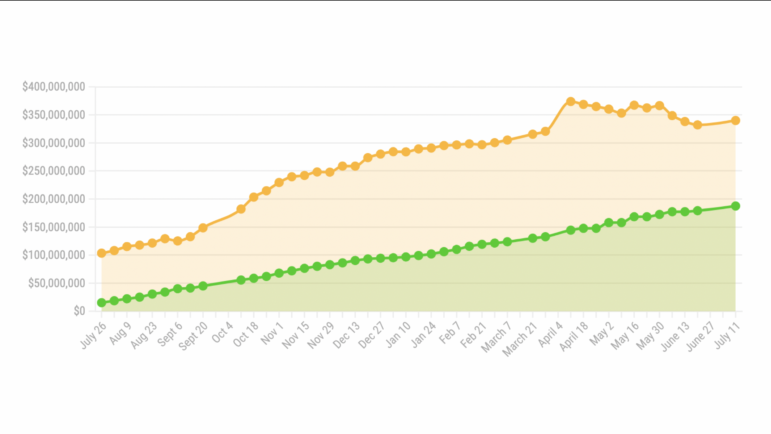

This is the latest snapshot of financial assistance to San Franciscans with rent debt, which we have been tracking on this page since February. We publish updated figures each week, except in weeks when new data is unavailable.

More than one month after statewide eviction protections expired on June 30, less than 4% of rent relief funds requested by San Francisco households remain unprocessed, with 55% of funds paid out.

Over 20,600 San Francisco households had asked for almost $340 million in rent and utility assistance from both state and local COVID-19 rent relief programs as of the week of July 11, government figures show. The amount requested declined 9% between April 11 and July 11 as the state continued to weed out ineligible applications. The state stopped accepting applications on March 31, more than a year after it opened a financial aid program to cover housing debt incurred by tenants due to pandemic hardship.

Households whose applications have been approved can stay an eviction even if they have not received payment yet; however, those with applications under review or pending applicant information — a category that applies to 1,154 applicants in San Francisco — are vulnerable to eviction.

California passed legislation to ensure all eligible households who applied by the March 31 deadline will receive funding. Recent budget proposals would earmark additional money for rent relief.

The following figures include San Francisco residents’ requests from California’s COVID-19 Rent Relief Program and San Francisco’s original Emergency Rental Assistance Program, which stopped taking applications in September 2021. It does not include requests from the city’s newest rent relief program, which began accepting applications April 1.

Over $140 million in rent and utilities requested from the state program by San Franciscans had been denied as of the week of July 11. Almost 1,000 San Francisco applicants appealed their denials.

On July 7, an Alameda County Superior Court judge barred the state from denying any more pending applications or any appeals of denials that occurred in the previous 30 days until a hearing is held to determine if applicants’ rights to due process were violated in the application review process.

In 2021, California received $5.2 billion for emergency rental assistance funds from the federal government. The state has since acquired nearly one out of every three dollars of federal reallocations of unused funds from other states, for a total of $198 million.

Tenants who had previously applied to the program and were awaiting rent relief were protected from eviction through June 30 for rent due between April 2020 and April 2022 under AB 2179. Under the same bill, local eviction protections passed unanimously by the Board of Supervisors in March were voided until July 1, but have since taken effect.

In response to the state’s move to cease accepting applications, the city reopened its own rent relief program for tenants who are seeking funds for rent debt accumulated in April and beyond. So far, it has distributed close to $4.3 million in funds to 713 of the 4,415 households that have applied, and residents who need help are encouraged to apply.

In its previous rent relief program, San Francisco assisted over 3,200 applicants with $22.8 million in relief. An additional $243,878 in requests from 53 households are yet to be processed.

The statewide eviction moratorium, protecting tenants who could not pay rent because of COVID-19 hardship, was originally scheduled to end Jan. 31, 2021, but lawmakers extended it twice. Following the moratorium’s final end date, Sept. 30, San Francisco tenants became vulnerable to eviction for nonpayment of rent if they had not paid at least 25% of the rents due in the preceding 13 months, as well as October’s rent.

However, California lawmakers did create some protections for renters who were unable to pay back rent after the moratorium expired. Tenants who applied to the state’s rent relief program before the deadline and were waiting on relief were protected from eviction through March 2022. State lawmakers in late March extended those protections through June 30.

Even though they may have been barred from evicting some tenants, starting in November 2021, landlords could sue tenants to obtain unpaid rent that was due from March 2020 through September 2021. If a landlord pursues the debt in small claims court, they and the tenant must represent themselves in the courtroom.

Are you facing eviction? Call the Eviction Defense Collaborative at (415) 659-9184 or send an email to [email protected] as soon as possible. The organization advises that tenants respond within five days of being served with court papers to avoid the risk of a default judgment against them.

Is your landlord suing you to recover pandemic rent debt? Go here to read our guide on how small claims court works, and how to argue your side of the case.